If you own property or are looking to buy, understanding flood zones and the need for flood insurance is crucial. Lenders often require flood insurance in high-risk areas to protect their investment, just like with standard homeowners insurance. This might lead to the requirement of a flood elevation certificate. So, how do you determine your flood zone and obtain this important document?

How to Find Your Flood Zone

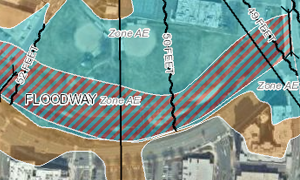

Flood zones categorize areas based on their flood risk. The main categories are:

- High-Risk Areas: Zones labeled A and V. These areas have the highest probability of flooding.

- Moderate to Low-Risk Areas: Zones labeled B, C, and X. While the risk is lower, flooding can still occur.

- Unmapped Areas (Unknown Risk): Zone D. Flood risk in these areas has not yet been determined.

You can easily check your property’s flood zone online through the FEMA Flood Map Service Center. Simply enter your address, and a detailed flood map of your area will appear. You may need to zoom in to clearly see the zone lines and labels.

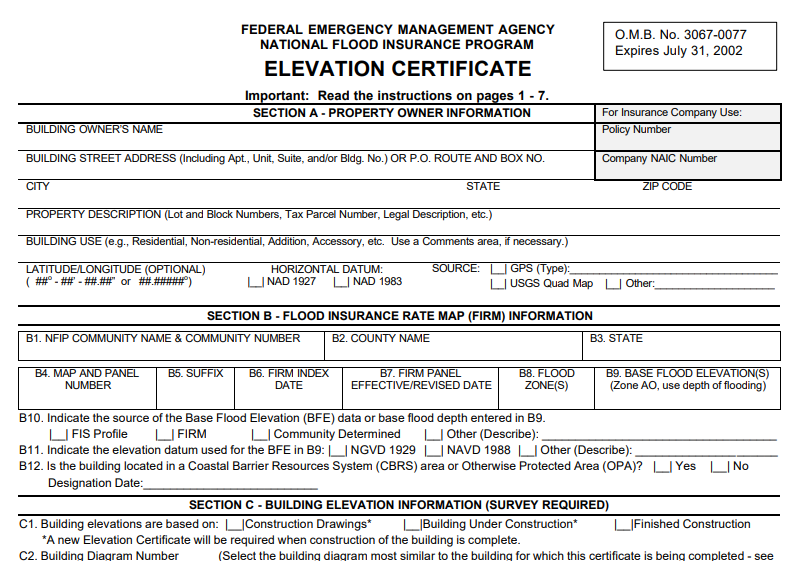

What is a Flood Elevation Certificate?

A flood elevation certificate is a document that provides the elevation of your property relative to the base flood elevation (BFE) in your area. Lenders often require this certificate when you’re purchasing property in a designated flood zone.

The certificate helps the lender document the flood risk associated with the property. Additionally, when you purchase flood insurance, the insurance company uses the elevation certificate to assess your property’s flood risk, which directly influences your coverage and premium.

It’s important to remember that even if your lender doesn’t mandate flood insurance because you’re in a moderate-to-low risk zone, flooding can still happen. FEMA data shows that a significant percentage of flood claims come from these areas.

How to Obtain a Flood Elevation Certificate

There are a few ways to get a flood elevation certificate:

- Seller May Have One: If you’re buying a property, the seller might already have a certificate. Be sure to ask.

- Seller May Obtain It: Depending on your purchase agreement, the seller might be responsible for obtaining and paying for the certificate.

- Hire a Professional: If the above options aren’t available, you’ll need to hire a licensed professional such as a land surveyor, engineer, or architect to create one. This process typically takes about a week and may cost around $600 (though your lender might cover this if they require it).

Navigating the process of buying a home in or near a flood zone can seem complex, but understanding flood zones and how to obtain an elevation certificate is a key step. At StreetSmart Insurance, we’re here to help you determine your flood risk and guide you through the process of obtaining the necessary documentation and insurance coverage. Contact us today for assistance.