When it comes to commercial trucking insurance, accuracy is paramount. One key factor that insurance companies consider is the radius within which your trucks operate. This radius, or the maximum one-way distance your vehicles travel, plays a significant role in determining your insurance premium. Let’s explore what a radius audit is and why it matters.

What Is a Radius Audit?

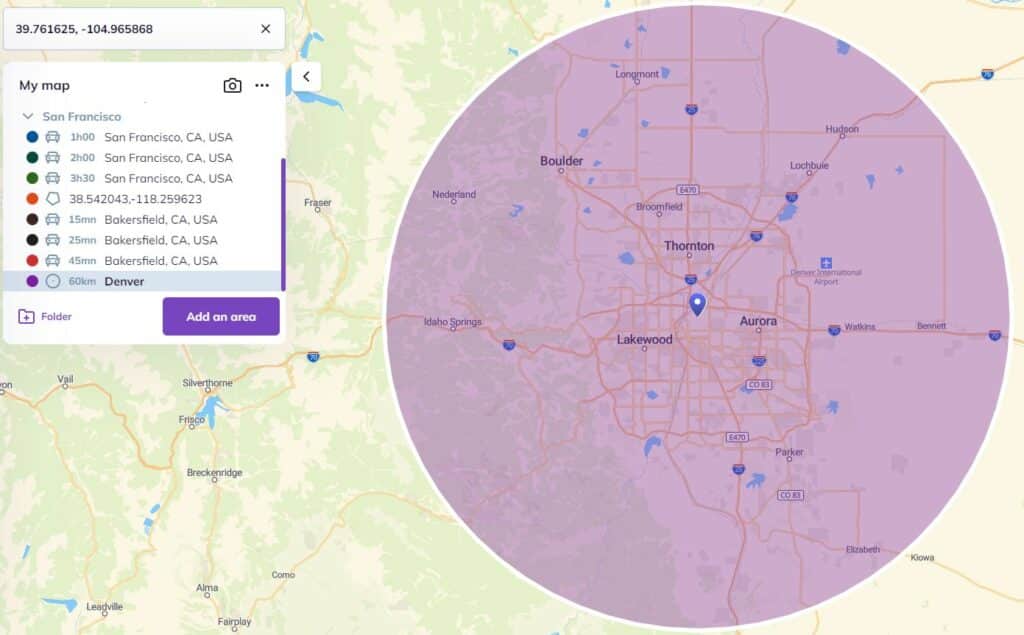

A radius audit is a process where your insurance company verifies the accuracy of the operating radius you’ve declared for your commercial trucks. This radius is typically measured in air miles from your garaging location to your delivery points.

Why Is Radius Important?

- Risk Assessment: Insurance companies assess risk based on the areas your trucks travel. A wider radius often implies higher risk.

- Accurate Premiums: Ensuring your radius is accurate helps avoid potential issues like claim delays, policy re-rating, or retroactive premium charges.

- Compliance: For policies with MCS-90 filings or USDOT numbers, radius accuracy is crucial for regulatory compliance.

What to Expect During a Radius Audit

Your insurer may request documentation to verify your operating radius, such as:

- International Fuel Tax Agreements (IFTAs)

- USDOT logs

- Toll logs

- SMS reports from SAFER

What You Can Do:

- Provide Accurate Information: Always declare your typical operating radius honestly.

- Keep Detailed Records: Maintain thorough records of your routes and mileage.

- Communicate with Your Insurer: If your operating radius changes, inform your insurer immediately.

Potential Consequences of Incorrect Radius

- Delays in claims processing.

- Policy re-rating, cancellation, or non-renewal.

- Retroactive premium charges.

Best Practices

- When obtaining insurance, have a clear understanding of your typical routes.

- If you’re a new company, declare an accurate radius based on your intended operations.

- If you are unsure of your radius, it is best to declare an unlimited radius.

Conclusion

By understanding and adhering to radius requirements, you can ensure accurate insurance coverage and avoid potential complications.