Planning a home improvement project? Whether it’s a small renovation or building your dream home, there’s a crucial piece of paper you need to request from every contractor you hire: a Certificate of Insurance, or COI.

What Exactly is a Certificate of Insurance (COI)?

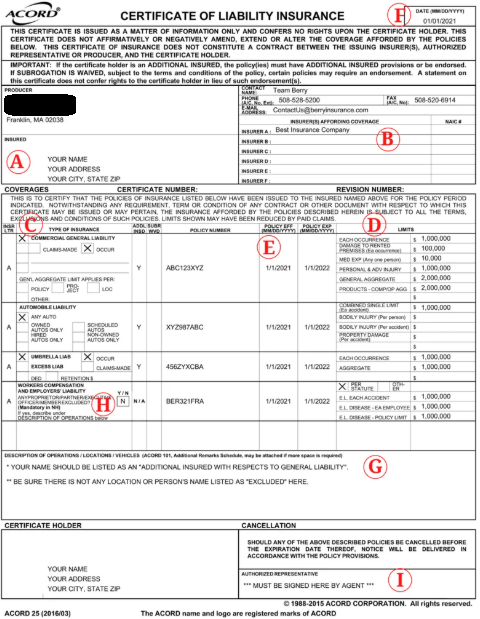

Think of a COI as proof that your contractor has insurance coverage. It’s a document, either digital or printed, that outlines the essential details of their business insurance policies. This includes the name of their company, the insurance provider, the types of coverage they have (like general liability or workers’ compensation), their policy numbers, the dates the policies are active, and their coverage limits.

Why Do You, as a Homeowner, Need a COI?

Getting a COI is about protecting you. It ensures that the contractor you’re working with has the right insurance in place to handle potential mishaps. If something goes wrong during the project – someone gets injured, or your property is damaged – the contractor’s insurance should step in, preventing you from being held liable.

Without a COI and adequate contractor insurance, you, the homeowner, could be on the hook for significant out-of-pocket expenses on top of what you’re already paying for the project.

How Do You Get a COI?

The good news is, it’s simple! Just ask your contractor to provide you with a COI from their insurance company or agent.

The contractor will then need to contact their commercial insurance agent and give them your name, address, and any specific insurance requirements you might have (more on that below). If the contractor has the necessary coverage, their agent will issue the COI for them to give to you. If their current insurance isn’t sufficient, they may need to purchase additional coverage or decline the job.

Key Insurance Types and Limits to Look For on the COI:

As a homeowner, understanding business insurance can be tricky. While the specifics can depend on your project, here are some essential coverages and general recommendations:

- General Liability Insurance: This protects your contractor’s business against claims of bodily injury or property damage they cause to someone else. We generally recommend your contractor have at least $1 million in general liability coverage. This can protect you if, for example, a contractor damages your property or injures you or a family member during the work.

- Workers’ Compensation: This covers medical expenses and lost wages for the contractor’s employees if they get injured on your property while working. It’s crucial to ensure the contractor has workers’ compensation coverage for their employees. If they don’t and a worker gets hurt, you could be held liable. We often recommend at least $500,000 in limits, but it can vary.

Sections of the COI to Pay Attention To:

When you receive the COI, take a close look at these sections:

- A. Named Insured: This should clearly state the name of the contractor or the contracting company.

- B. Insurance company: This section shows the insurance company your contractor has the business insurance policy through. Sometimes, there may be more than one insurance company listed. This just means they have different carriers for their different types of insurance. You’ll want to look at the insurance types section to make sure the correct policies correspond with the correct carriers.

- C. Insurance Types: Verify that the COI lists the types of insurance you requested (at a minimum, General Liability and Workers’ Compensation).

- D. Limits: Ensure the coverage limits listed meet the amounts you requested (e.g., $1 million for General Liability).

- E. Policy Effective Date: Check that the policy is currently active and will remain active throughout your project. If the expiration date is before your project ends, request a new COI upon renewal.

- F. COI date issued: The date issued shows the date the COI was created, so for one, you’ll just want to double check that the date is correct and within the policy effective period. You’ll also want to note that a COI is only a snapshot in time, meaning that it can only prove insurance was active on the issue date. Theoretically, a contractor could get a COI as proof of insurance, then cancel the policy the next day. (We’ll get into what to do about that in section G.)

- G. Special Conditions: This section should ideally list your property address and any specific requirements, such as being listed as an “additional insured.” Being listed as an additional insured can provide you with direct coverage under the contractor’s policy for claims arising from their work.

- H. Workers’ compensation: Under the workers’ compensation section, there will be a check box indicating whether the owner is included under the policy. Sole proprietors and officers of corporations can opt out of workers’ comp coverage, so the check box will show you whether they are included or not. There may also be language about it in the special conditions section if the owner is not included. If this is the case, you should require they not be exempt from the coverage — anybody working on your home should have workers compensation coverage.

- I. Signature: And of course, you will want to make sure the document is signed by the contractors insurance agent, indicating that it is official.

Protect Your Investment with a COI

While asking for a COI might seem like an extra step, it’s a vital way to protect yourself and your home during any improvement project. At StreetSmart Insurance, we strongly recommend that all homeowners request and carefully review COIs from their contractors. It’s a simple action that can save you significant headaches and expenses down the road.